Tax 的用語

背景說明:上周幫了一個同學處理了一個conference 的獎金問題,那個國際 conference 今年輪到在台灣辦,由於是台灣的教授的助理來處理,但是又都要用英文,於是就發生了一些詞不達意的情形,產生了一些誤會,後來還好在適當的解釋後解決了!

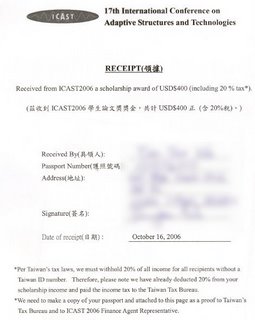

這個conference 有一些獎金,來獎助優秀的論文作者的旅費,但是給錢的時候,要簽領據,有報稅的問題,於是,問題就來了:請看右圖,這樣的說明,說真的,要不是我對這種事還有點sense,要不然還真的是看不懂。

我把原文再quote一次如下:

Receipt (領據)

Received from xxxx2006 a scholarship award of USD$400 (including 20% tax*)

..............

*Per Taiwan's tax laws, we must withhold 20% of all income for all recipients without a Taiwan ID number. Therefore, please note we have already deducted 20% from your scholarship income and paid the income tax to the Taiwan Tax Bureau.

*We need to make a copy of your passport and attached to this page as a proof to Taiwan's Tax Bureau and to xxxx2006 Finance Agent Representative.

(1)您不覺得這樣的寫法用在 conference 上有點rude 嗎? 全部都用主動語態,感覺像將是個人意志強加在別人身上。

(2)另外,第一句的邏輯也有點不太正確,她寫說USD$400 (including 20% tax),為什麼是 including tax 呢?含稅不含稅又怎樣?又不是買東西。

重點應該是:「要課稅」,她要表達的重點是指「真正領到的錢是稅後金額」,所以要寫作 is subject to tax,而不是 including tax。

以下是我提供的寫法:

Receipt of ICAST 2006 scholarship award in the amount of US$400 (subject to 20% income tax withhold)

*Per Taiwan's tax code, 20% of the award income for the receivers without a valid Taiwan ID number has to be withheld at the time of payment. Please note that the amount in this payment is after this tax withheld.

*A photocopy of your passport is required for tax filing purpose. For your convenience, we are glad to assist you in making this photocopy at no charge.

這樣寫才比較像正式吧!

0 Comments:

Post a Comment

<< Home